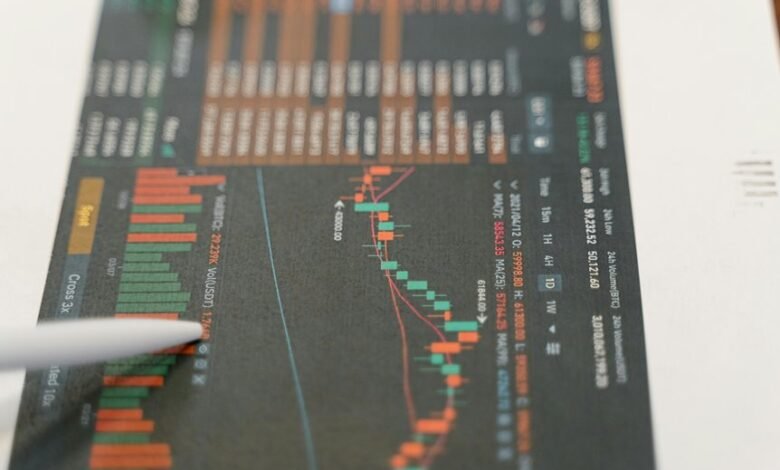

Investment Growth Indicators for 582671638, 25600112, 2130392750, 911177566, 4808416993, 726399242

Investment growth indicators for identifiers 582671638, 25600112, 2130392750, 911177566, 4808416993, and 726399242 reveal varying levels of performance and risk. The first three identifiers display strong resilience, while 911177566 presents stability. In contrast, the latter two exhibit notable volatility. This disparity highlights the necessity for tailored investment strategies. Understanding these dynamics could be pivotal for investors seeking to optimize their portfolios in an ever-evolving market landscape. What factors drive these divergent trends?

Overview of Investment Identifier 582671638

Investment Identifier 582671638 represents a unique asset within the broader financial landscape, characterized by its specific investment parameters and performance metrics.

A thorough risk assessment reveals manageable uncertainties, while its market potential indicates significant opportunities for growth.

Investors seeking freedom in their financial choices may find this asset appealing, as it balances calculated risks with advantageous returns, positioning it favorably in diverse portfolios.

Analysis of Investment Identifier 25600112

Asset Identifier 25600112 presents a compelling case for investors through its robust performance metrics and strategic positioning in the market.

A thorough risk assessment reveals resilience against market volatility, indicating a favorable environment for potential growth.

Performance Insights for Investment Identifier 2130392750

Performance metrics for Identifier 2130392750 reveal a noteworthy trajectory that merits close examination by potential stakeholders.

The investment demonstrates resilience amidst market volatility, suggesting a robust risk assessment framework. Key indicators highlight its capacity for sustained growth while mitigating potential downturns.

Stakeholders focused on freedom in investment strategies will find this identifier particularly appealing for balancing risk and return in a dynamic market environment.

Growth Trends for Investment Identifiers 911177566, 4808416993, and 726399242

The analysis of growth trends for Investment Identifiers 911177566, 4808416993, and 726399242 reveals distinct patterns that characterize their market behavior.

Each identifier demonstrates significant growth potential, with varying market performance influencing future projections.

A thorough risk assessment indicates that while 911177566 shows stability, 4808416993 and 726399242 present higher volatility, necessitating informed strategies for investors seeking to maximize returns while managing risks effectively.

Conclusion

In the ever-shifting landscape of investment opportunities, identifiers 582671638, 25600112, and 2130392750 stand as resilient pillars, weathering market storms with steadfast resolve. Meanwhile, 911177566 chart a steady course, offering stability amidst a tempest of volatility exemplified by 4808416993 and 726399242. This intricate tapestry of growth trends illustrates the necessity for bespoke investment strategies, allowing investors to navigate the labyrinth of risk and reward, ultimately fostering a flourishing financial future.